Jeffrey Buchbinder, CFA, Chief Equity Strategist

Adam Turnquist, CMT, Chief Technical Strategist

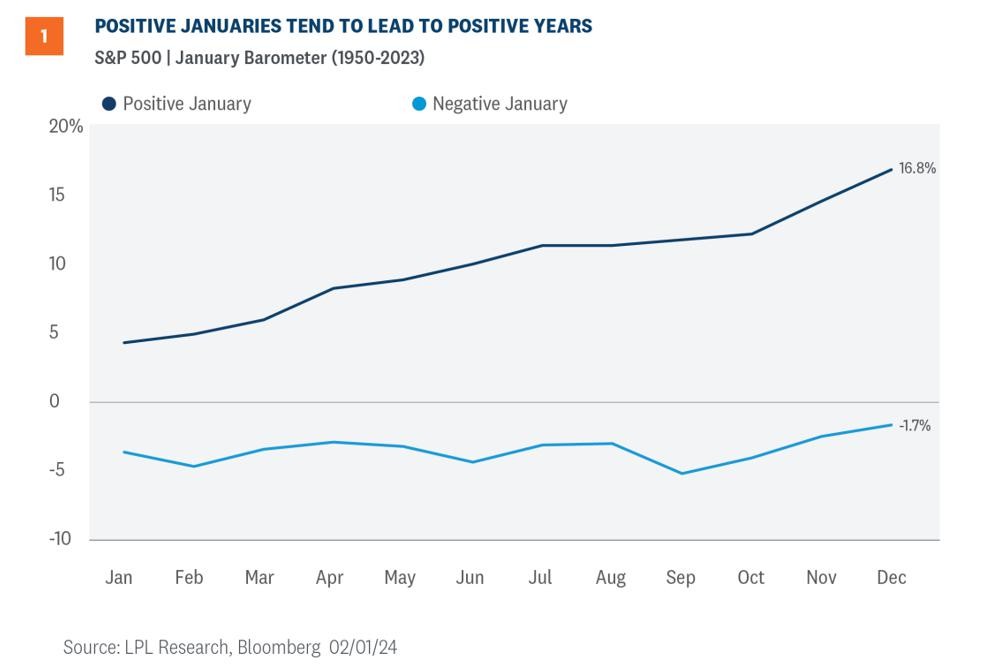

A positive January has historically been a bullish sign for stocks. Yale Hirsch, the creator of the “Stock Trader’s Almanac”, first discovered this seasonal pattern back in 1972, which he called the January Barometer and coined its popular tagline of ‘As goes January, so goes this year.’ Here, we assess the likelihood that this popular stock market adage delivers more gains for investors this year. The weight of the evidence leans toward yes, as we explain.