The bar for third quarter earnings is low, with analysts currently expecting only about a 3% increase in S&P 500 earnings per share (EPS). That low bar and a supportive economic environment points to potential upside. However, stocks may already be pricing in solid results, with the S&P 500 up more than 7% since the third quarter began on July 1. Here we preview earnings season and discuss some of the key drivers of earnings growth in the year ahead.

On October 12, 2022, there were very few comments suggesting that a new bull market was in thethroes of being born as the S&P 500 opened at 3,590.83 and closed at 3,577.03.

After all, inflation was still running hot even though the Federal Reserve (Fed) began its rate-hiking campaign on March 16, 2022, by raising rates by 25 basis points (0.25%) and moving to a 50-basispoint hike on May 5, 2022, as it tried to quell inflationary pressures. By mid-June, a series of 75- basis-point hikes were introduced as the Consumer Price Index (CPI) peaked in June at 9.1%.

When it comes to investing, gold may be the antithesis of artificial intelligence (AI). The precious metal has acted as a store of value for thousands of years with zero technological innovation — gold is discovered, not developed. Gold is also a real tangible asset and can act as a potential hedge against inflation or a safe haven during times of crisis. Given these properties and the backdrop of a risk-on-record-setting equity market, many investors are wondering what’s behind the paradoxical price action of gold’s rally to new highs and how the yellow metal has matched the momentum in AI stocks over the last several months (gold and the equal-weight Magnificent Seven Index are both up around 20% since March). Herein we discuss the key drivers of gold and why this rally is no flash in the pan.

With the first presidential debate behind us, it’s safe to say election season is in full swing. While last week’s debate was light on economic policies, the future of tax policy (along with potential efforts to arrest elevated federal deficits) could have broad implications for the municipal (muni) market — some good, some not so good. With the Tax Cuts and Jobs Act (TCJA) set to sunset in 2025, the election will go a long way in determining the future of tax policy in the U.S. And for muni securities and their unique tax-exemption characteristics, the election will go a long way in determining future demand for the asset class. But with the Federal Reserve (Fed) embarking on a rate cutting cycle likely starting this week, the next few months could be the last “best time” to buy munis, regardless of changes to tax policy.

When Fortune magazine asked an AI model to sum up Wall Street’s 2026 outlook in a single word, the result was the word “precarious.” It’s an interesting choice—and not entirely wrong. With markets weighing shifting interest rates, inflation trends, talk of an AI bubble and global realignments, “precarious” certainly could capture the moment. Yet while some analysts accept that word, you have the opportunity to choose your own.

Second quarter earnings season is in the books, and it was a good one. S&P 500 companies collectively grew earnings at a double-digit pace for the first time in three years. Companies beat estimates at a solid 79% clip. Guidance from company CEOs and CFOs was relatively upbeat. And although some were a bit disappointed by big technology results based on stock reactions, the problem was high expectations more than anything else.

Every year as the summer months draw near their end, LPL Financial hosts its annual conference for financial advisors. While the conference is an excellent opportunity for advisors to expand upon professional interests, discover ways to enhance their impact on clients, and connect with industry experts — learning is a two-way street. At this year’s big event with nearly 9,000 attendees in sunny San Diego, the LPL Research team had the unique opportunity to connect with many of these advisors in person to get their perspectives on the capital markets. Below are some of the frequently asked questions from the road.

The LPL Strategic & Tactical Asset Allocation Committee (STAAC) determines the firm’s investment outlook and asset allocation that helps define LPL Research’s investment models and overall strategic and tactical investment thinking and guidance. The committee is chaired by the chief investment officer and includes investment specialists from multiple investment disciplines and areas of focus. The STAAC meets weekly to foster a close monitoring of all global economic and capital markets conditions to ensure that all the latest information is being digested and incorporated into its investment thought.

With stock valuations elevated after such a strong first half, earnings growth will be key to holding, or potentially building on these gains. LPL Research believes stocks have gotten a bit over their skis, but earnings season may not be the catalyst for a pullback in the near term given all signs point to another solid earnings season and stocks have mostly performed well during the peak weeks of reporting season in recent years. We may not get an increase in second-half estimates over the next couple of months — that's a lot to ask — but we should get a few points of upside and double-digit earnings growth for the second quarter on the back of technology strength.

Developments in artificial intelligence may be the antidote for an aging population, but it takes time for these advancements to work themselves into the fabric of our nation’s businesses. The impact of new developments can persist in markets, so investors need to carefully discern what could be different this time around.

The LPL Strategic & Tactical Asset Allocation Committee (STAAC) determines the firm’s investment outlook and asset allocation that helps define LPL Research’s investment models and overall strategic and tactical investment thinking and guidance. The committee is chaired by the chief investment officer and includes investment specialists from multiple investment disciplines and areas of focus. The STAAC meets weekly to foster a close monitoring of all global economic and capital markets conditions to ensure that all the latest information is being digested and incorporated into its investment thought.

Jeffrey Roach, PhD, Chief Economist

Jeffrey Buchbinder, CFA, Chief Equity Strategist

When we wrote the annual outlook last November, the data was mixed. Some metrics hinted at emerging cracks in the economy while others suggested the growth trajectory in capital markets and the economy had legs. So, the variety of the data produced the narrative that business activity in the New Year would grow on an annual basis but experience some bumps in the first half of the year. Now, enter the revisions.

Navigating finances can feel a bit like a winter sport—fast, unpredictable, and occasionally breathtaking. And this week has seen plenty of motion, few places to pause, and moments that naturally test our balance. The constant activity and notifications can sometimes feel too noisy, but the 2026 Winter Olympic Games offer a useful reminder: your most important progress always comes back to fundamentals.

The athletes who perform best aren’t chasing chaos or trying to be the best in everything. They’re focused on discipline, consistency, and pacing, especially amid unpredictable (and cold!) conditions. The takeaway: How you move through your challenges matter.

Jeffrey Buchbinder, CFA, Chief Equity Strategist

Adam Turnquist, CMT, Chief Technical Strategist

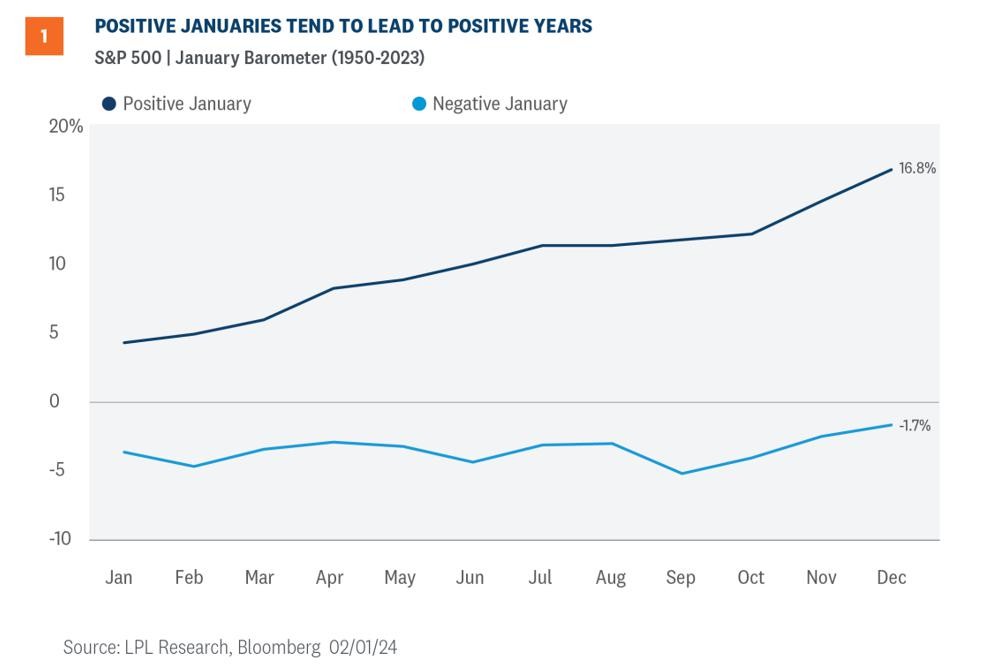

A positive January has historically been a bullish sign for stocks. Yale Hirsch, the creator of the “Stock Trader’s Almanac”, first discovered this seasonal pattern back in 1972, which he called the January Barometer and coined its popular tagline of ‘As goes January, so goes this year.’ Here, we assess the likelihood that this popular stock market adage delivers more gains for investors this year. The weight of the evidence leans toward yes, as we explain.

As December rolls forward, it’s natural to reflect on another year almost in the books. This time of year invites introspection, offering us a moment to pause, look back at where we've been, and prepare for where we’re headed. It’s an interval brimming with potential and an opportune moment to reflect on one of the most crucial aspects of financial planning and investment—timing.

In our financial endeavors and personal journeys, timing often emerges as the invisible hand that guides success. Just as the right decision made at the right moment can accelerate growth, a mistimed move can create undesirable challenges. As we prepare to bid farewell to 2024 and usher in a promising new year, understanding the nuances of timing can empower you to seize opportunities and navigate potential pitfalls with perspicacious agility.

The imposition of tariffs by the United States this week has understandably sparked volatility in the markets.

It's in the face of such challenges that our diversified, strategically balanced, long-term approach demonstrate their true value. Our goal has always been to withstand market ups and downs, minimizing exposure to individual market events and maximizing potential returns through diversified investments across various asset classes.

When it comes to investing, the biggest threat to your portfolio isn’t the market—it’s your own brain. Evolution equipped us to survive in a world of immediate threats, not to stay calm in the face of volatile markets or abstract probabilities. As a result, our instincts often push us toward short-term comfort and away from long-term wealth.

We buy when others are euphoric, sell when fear takes hold, and convince ourselves that this time is different. As decades of behavioral research have shown, investors usually lose not because the odds are stacked against them—but because their biases and impulses overpower their logic.

For decades, U.S. Treasury bonds were regarded as among the safest of investments—so reliable, in fact, that they came to be viewed as the foundation of the global financial system.

But today we are facing an environment where those old assumptions may no longer hold true. With U.S. debt growing at an accelerating pace, confidence in Treasuries is being tested in ways we have not seen for generations. What was once considered unquestionably secure is now subject to doubt, challenging the traditional idea that there are permanent “safe havens” in investing.